I hope the summer is treating you well! As we enter the second half of 2024, now is the perfect time to review the last quarter.

Overall, bulls continued to run during the second quarter of 2024 as several major stock indexes broke out of recent trading ranges to the upside.

Tallying the quarter, the S&P 500 increased by approximately 3.90%, the Nasdaq Composite rose by close to 8.1%, and the Dow Jones Industrial Average decreased by nearly 1.7%.

Economy

Rewind to the beginning of the year, and the talk of the town was as many as six rate cuts to come this year. Courtesy of sticky inflation (which has recently shown early signs of potentially softening), the narrative has changed significantly since then. Current expectations are for a Fed Funds rate cut in September of this year.

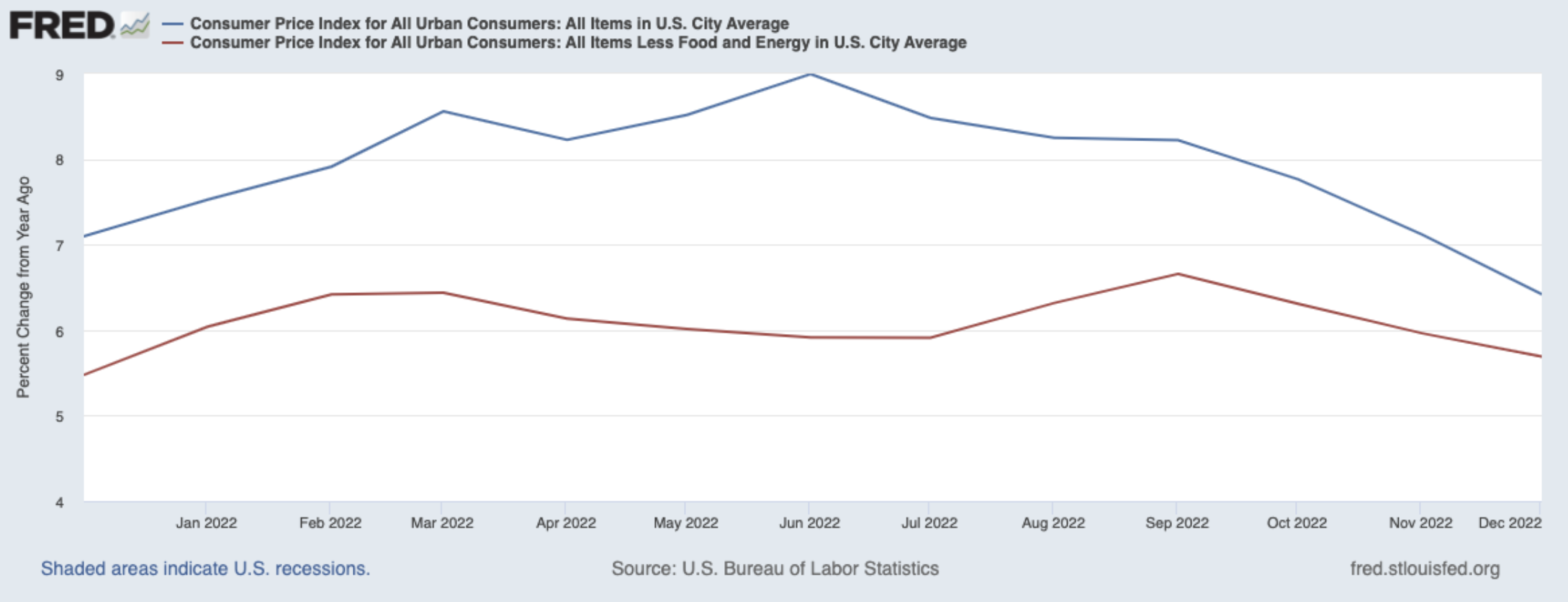

Inflation

The year-over-year Consumer Price Index inflation rate declined in Q2, with the CPI reading of the June showing consumer prices declined 0.1% month-over-month and year-over-year inflation running at 3.0%.

Core CPI (which removes more volatile food and energy from the metric) dropped to a three-year low of 3.3% in June, potentially bolstering the case for rate cuts down the line. This metric illustrates just how much the necessities of food and energy contribute to the inflationary pressures here in America.

U.S. equities loved seeing inflation metrics tick lower throughout the second quarter, and the S&P 500 continued to make fresh all-time highs even into July.

Labor Market

Labor markets remained mostly steady to higher throughout Q2, with payroll gains (206,000 in June, 272,000 in May, 175,000 in April) in each month and June and May data beating analyst consensus expectations.

For June, the unemployment rate rose to 4.1%, higher than the estimated 4.0% and the highest level since November 2021. The unemployment rate has inched higher each month for the past three months, potential signs that the Fed’s rate hike crusade has dampened the U.S. economy.

Quarterly Fed Expectations

The second quarter featured two Federal Reserve (Fed) policy meetings. The Fed left rates unchanged both times, in line with market expectations. The result is a current target overnight lending rate of 5.25 – 5.50%.

More importantly, the Fed has set expectations that it will cut rates only once in 2024.

In the third quarter, there will be two Fed meetings: July 31st and September 18th. As of early July, markets were pricing a 91.2% probability of no rate cut in July and a 84.6% probability of a 25-basis-point cut in September, per the CME FedWatch Tool.

Pre-Election Rate Cut Debate

Even with a 84.6% probability of a Fed rate cut at the September meeting, much controversy surrounds such a cut, as some market participants argue that a cut could bolster the economy and show potential favoritism to the incumbent. This will likely remain a topic of discussion as the time remaining until Election Day ticks down.

Generational Opportunity in Bonds?

It has been a multi-year slog for bond investors, to say the least, but I believe there is hope on the horizon.

Looking at the Bloomberg US Aggregate Bond Index’s largest drawdown periods from 1976-2024, we can see that this drawdown has reached extreme levels. Should inflation continue to decelerate or decrease, it could be a time when smart money looks to bonds, given the value proposition.

Not as trendy as AI-fueled stocks, bonds do stand the test of time, and there is ample math that supports these fixed-income assets. Something to keep an eye on as inflation continues to cool and unemployment trends higher.

From Q2 to Q3: A Summary

Of course, much attention will continue to be paid to inflation data and Fedspeak. The Fed has broadcast its intentions for one rate cut in 2024, with the CME FedWatch Tool showing current expectations for one in September. The presidential election later this year adds an element of uncertainty to trying to “time” an interest rate cut.

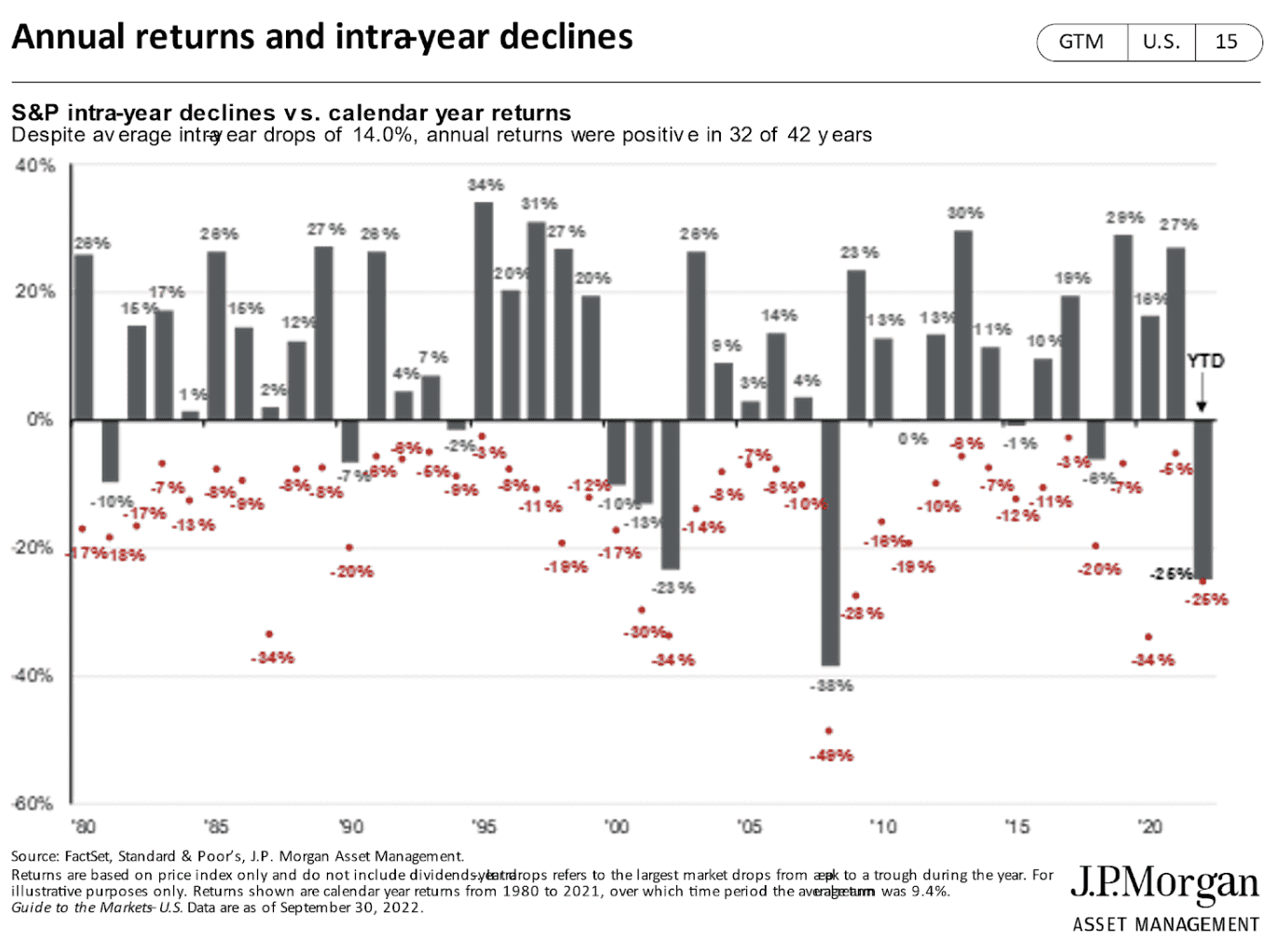

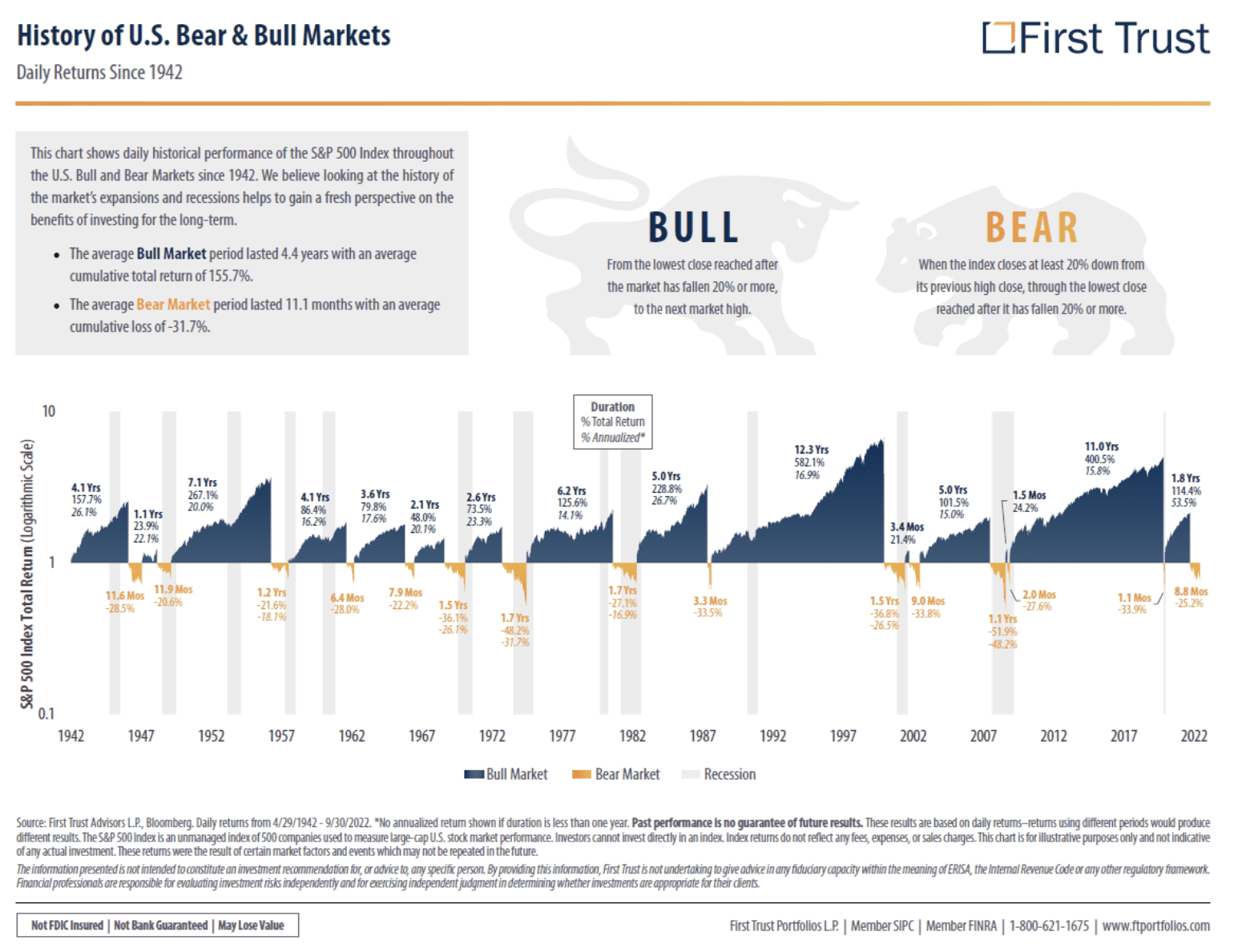

But, putting those two things aside, portfolio diversification and a long-term focus have long been the winning formula for investors. Moreover, remaining focused on the long term allows an investor to avoid getting caught up in quickly changing narratives that could trigger emotional decisions.

With that overview noted, if Q2 market developments are on your mind or if there is anything else we can help with, please feel free to reach out to your advisor—we are always here as a resource for you!

Be Well,

Andrew Fairman, CFA, CFP®

Chief Investment Officer