My goal is to give you a brief mid-year market commentary for 2022 and provide some insight into what I’ll be watching and following over the next few months.

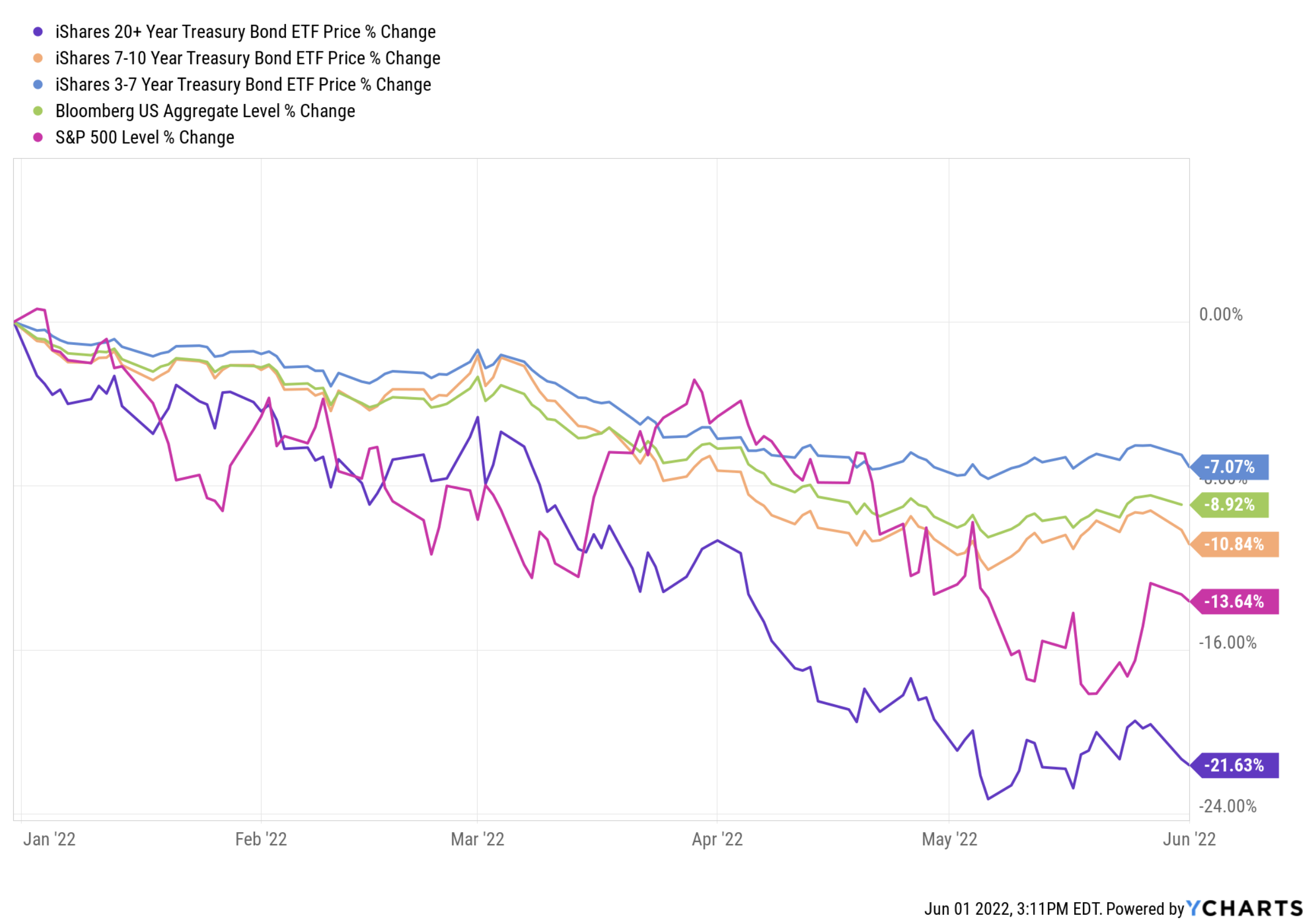

Frankly, the first half of 2022 has not been enjoyable if you’re an investor. The S&P 500 (a broad measure of US stocks) is lower by more than 20% and the BloombergBarclays US Aggregate Bond Index (a measure of investment grade bonds) is lower by more than 12%.

The fact that both indexes are down so much and at the same time is extremely uncommon. We all know that financial assets are subject to downside risks, but that certainly doesn’t make times like these any easier. It’s felt in our account statements and the prices we pay at the pump or at grocery store.

On the minds of most investors these days is inflation and whether it is here to stay. Investors were caught off-guard earlier this month when the CPI (consumer price index) data for the month of May came in higher than expected. Consumer prices increased 1% in May vs. 0.3% in April and above economists’ estimates.

I would highly encourage you to take these single data points with a grain of salt and instead follow the longer-term trends as a better indicator of direction. Temporary factors and a relatively small sample size can create a lot of statistical noise which influences the output of the data.

The crystal ball I ordered is still on a container ship somewhere in the Pacific, but I’m confident inflation won’t be at these levels forever. The bad news is that it won’t be an overnight process to normalize and it’s going to take some natural economic healing and Fed action to make this happen.

As you may know, the Federal Reserve opted to raise the Fed Funds Rate by 75 basis points or 0.75% at last week’s meeting. This action is meant to slow down economic activity with the intention of cooling inflation. The main risk to this action is that they could unintentionally throw our economy into a recession if it cools too much. It is my opinion that they are walking a fine line and only time will tell if they are successful at bringing down inflation while avoiding a recession.

As investors, we don’t have control over the economy or Fed policy, but times like these do give us some opportunities. For instance, in taxable accounts we are actively looking to capture capital losses for which clients can use to offset a portion of income as well as carry-forward these losses to offset future capital gains. This opportunity allows us to improve after-tax returns when markets ultimately improve.

Additionally, we are looking to rebalance portfolios that have drifted from their target investment weights. I view this operation as a risk management technique that ultimately allows us to buy low and sell high and takes the emotion out of investment decision making. Rebalancing also has been proven to lower portfolio volatility and adding to return relative to a “buy and hold” strategy.

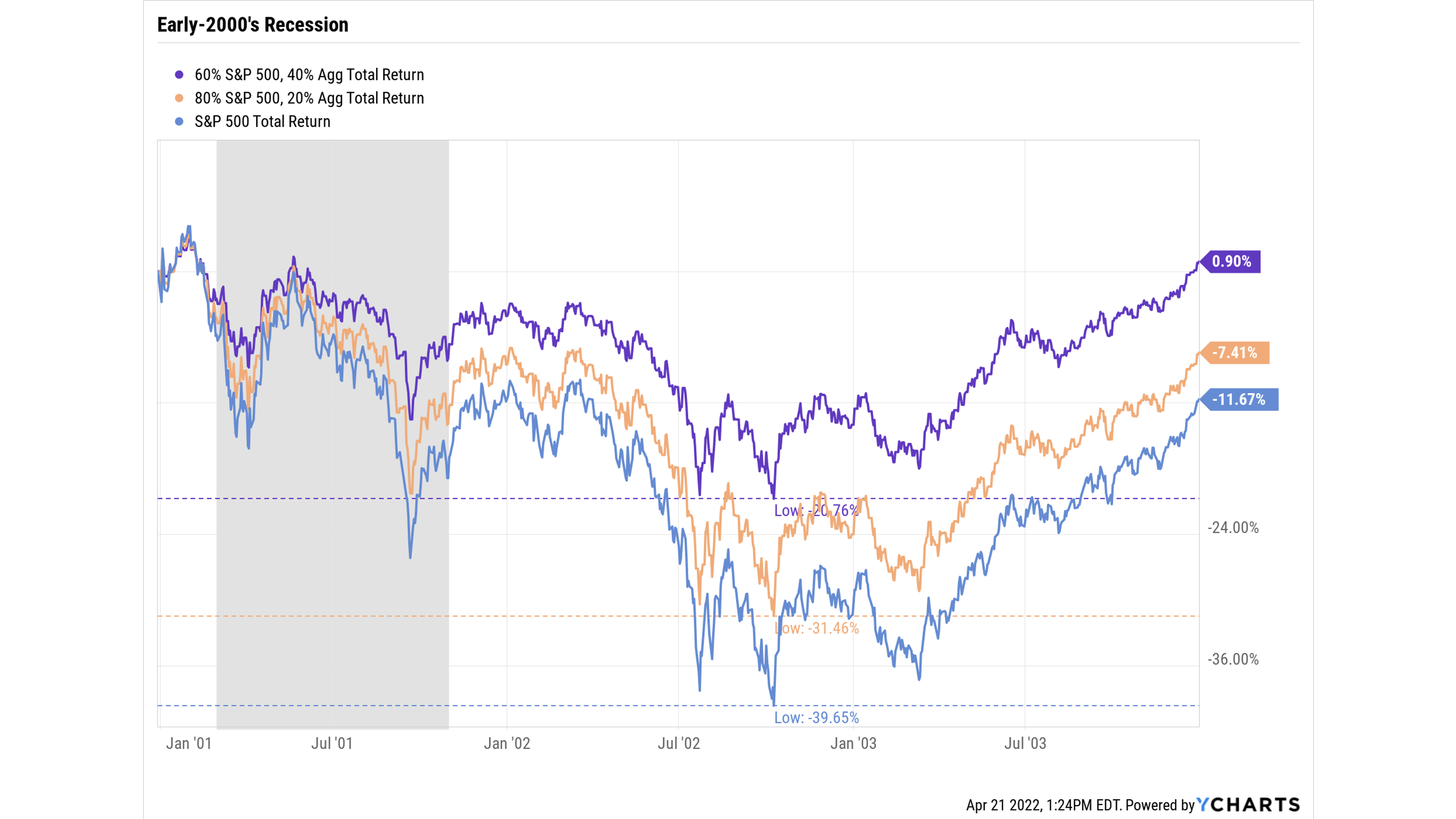

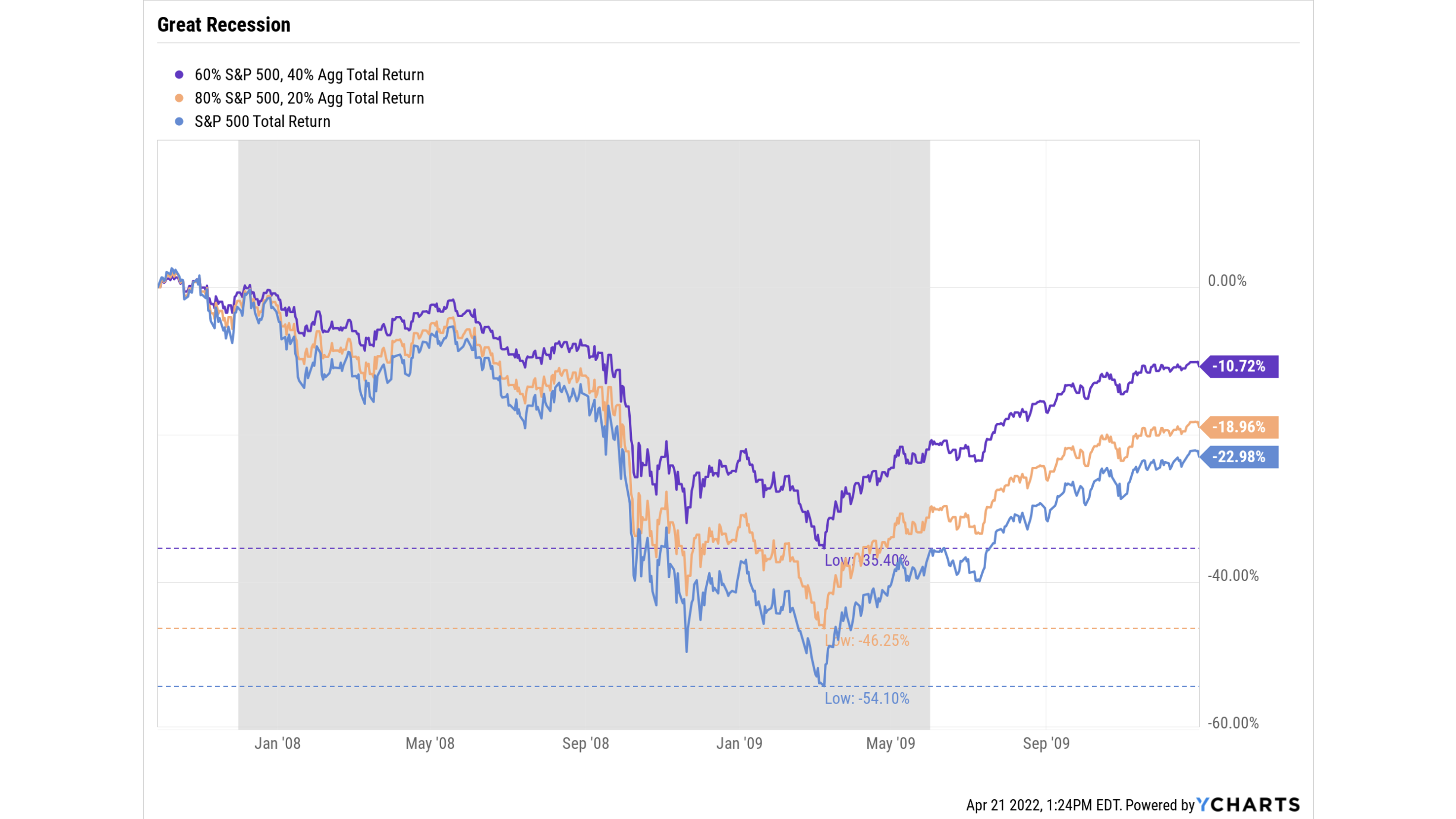

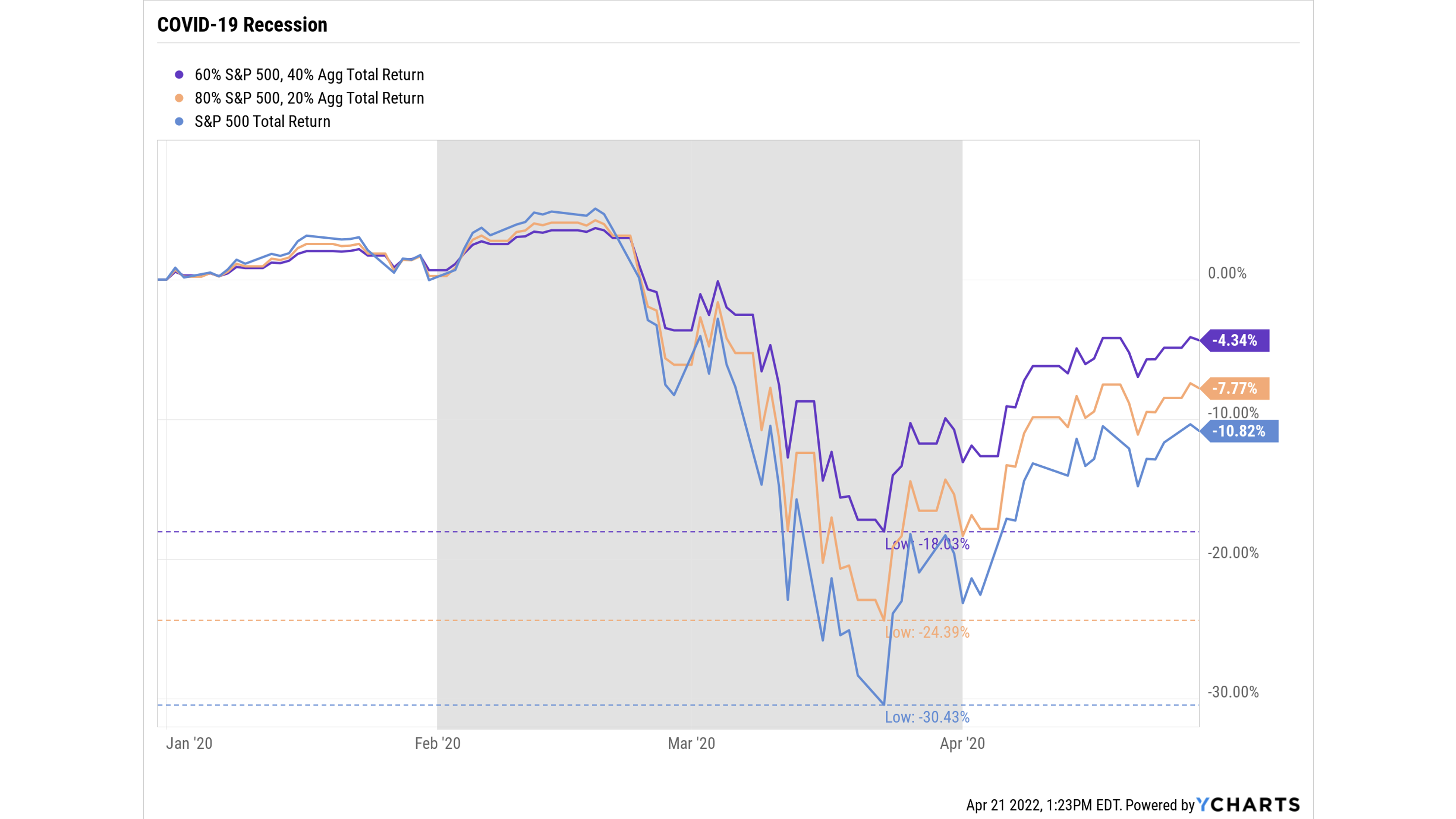

Which brings up another opportunity these types of markets create. Now is a great time to, if you haven’t already, have a discussion with your financial advisor to revisit your goals and priorities. As humans, volatile markets have the ability to trigger a negative emotional response, but working with an advisor to help you get through the rough times and keep the focus on the long-term can be invaluable.